Advertisement

Popular Now

In an increasingly digital world, managing your finances has become more accessible and efficient than ever. With the advent of finance apps, you can now take control of your budget, investments, savings, and overall financial health—all from the convenience of your smartphone. Whether you're a seasoned investor or just starting your financial journey, the right finance app can make all the difference. In this article, we'll explore the top 5 finance apps that are transforming the way people manage their money.

1. Mint: Comprehensive Budgeting Made Simple

Mint has long been a go-to app for anyone looking to streamline their budgeting process. With its easy-to-use interface and powerful tools, Mint allows users to track their spending, set budgets, and monitor their financial health in real-time. The app connects to your bank accounts, credit cards, and bills, automatically categorizing transactions to give you a clear picture of your financial situation.

Key Features of Mint

- Automatic transaction categorization

- Budget creation and tracking

- Credit score monitoring

- Bill reminders and payment tracking

Pros of Mint

Mint is free to use, making it accessible to everyone. Its comprehensive features, including budget tracking, bill reminders, and credit score monitoring, make it a powerful tool for managing personal finances.Cons of Mint

While Mint offers a wealth of features, some users may find the app's ads intrusive. Additionally, the app's reliance on syncing with external accounts can sometimes lead to delays or errors in updating transactions.2. YNAB (You Need a Budget): Mastering the Art of Budgeting

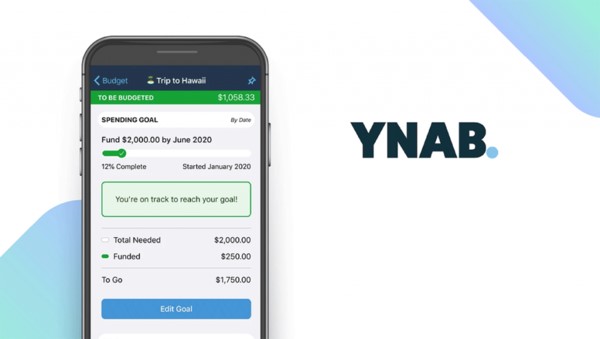

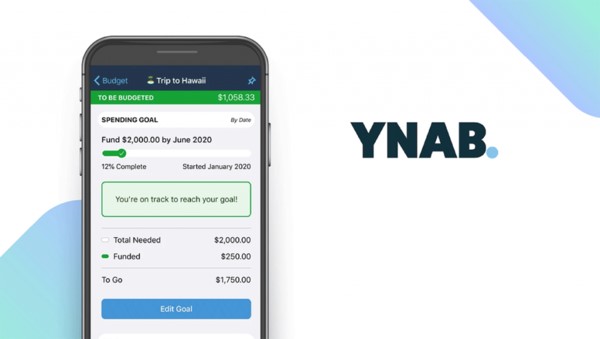

YNAB, short for You Need a Budget, is a finance app that focuses on proactive financial planning. Unlike traditional budgeting apps, YNAB emphasizes the importance of giving every dollar a job, helping users allocate their money effectively and avoid unnecessary expenses. The app encourages users to plan ahead, ensuring that they have enough money to cover future expenses and achieve their financial goals.Key Features of YNAB

- Zero-based budgeting

- Real-time expense tracking

- Goal setting and progress tracking

- Educational resources and community support

Pros of YNAB

YNAB's proactive approach to budgeting makes it an excellent choice for those who want to take control of their finances. The app's educational resources and supportive community provide users with the knowledge and motivation they need to succeed.Cons of YNAB

YNAB is a subscription-based service, which may be a drawback for some users. Additionally, the app's learning curve can be steep for those new to zero-based budgeting.3. Personal Capital: Your All-in-One Financial Dashboard

Personal Capital is a finance app that offers a comprehensive view of your financial health, combining budgeting tools with investment tracking and retirement planning. The app connects to your financial accounts, providing a detailed overview of your net worth, investment performance, and spending habits.Key Features of Personal Capital

- Investment tracking and analysis

- Retirement planning tools

- Net worth monitoring

- Fee analysis for investment accounts

Pros of Personal Capital

Personal Capital offers a comprehensive view of your financial health, making it a valuable tool for both budgeting and investing. The app's ability to track investments, plan for retirement, and monitor net worth provides users with a holistic view of their finances.Cons of Personal Capital

Personal Capital's focus on investment and wealth management may be overwhelming for users who are primarily looking for basic budgeting tools. The app's free version is limited, with more advanced features available through a paid advisory service.4. Acorns: Investing Spare Change for the Future

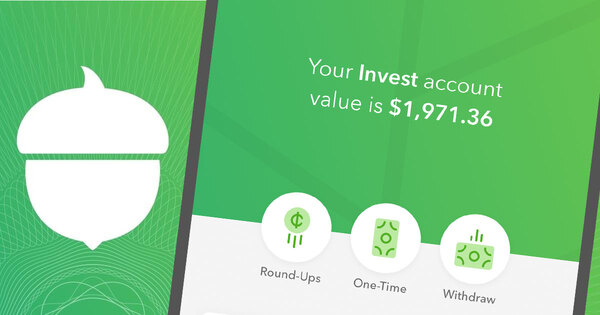

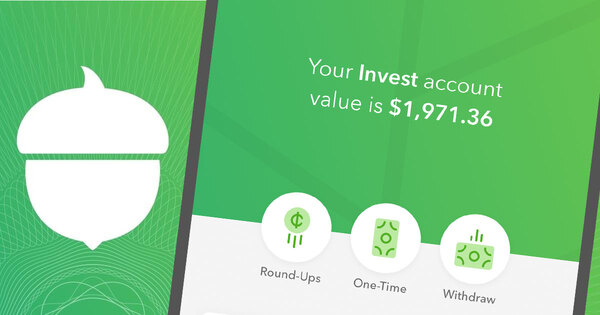

Acorns is an investing app designed to make investing easy and accessible for everyone. The app rounds up your everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio. Acorns is ideal for those who want to start investing without needing to manage their portfolios actively.

Key Features of Acorns

- Automatic round-up investing

- Customizable portfolio options

- Retirement accounts (IRA)

- Educational resources for new investors

Pros of Acorns

Acorns' simplicity and automation make it a great option for beginners who want to start investing with minimal effort. The app's educational resources also provide valuable guidance for new investors.Cons of Acorns

Acorns charges a monthly fee, which may be a disadvantage for users with smaller account balances. Additionally, the app's investment options are limited compared to more advanced investing platforms.5. Robinhood: Commission-Free Trading for All

Robinhood has revolutionized the world of investing by offering commission-free trading. The app allows users to buy and sell stocks, ETFs, options, and cryptocurrencies without paying traditional brokerage fees. Robinhood is popular among both beginner and experienced investors for its ease of use and low-cost trading.

Key Features of Robinhood

- Commission-free trading

- Support for stocks, ETFs, options, and cryptocurrencies

- Real-time market data and news

- Fractional shares investing